Public Sector Finance Mechanisms

Recognizing the vital role that carbon capture, utilization, and storage (CCUS) will play in efforts to address climate change, the U.S. federal government has recently enacted important programs to accelerate and support the development of CCUS.

By expanding and enhancing the section 45Q tax credit, Congress has made the credit significantly more accessible to investors and developers. As such, industrial sectors that have previously lacked the proper decarbonization incentives will now be more likely to participate in the carbon capture and storage ecosystem. In the Infrastructure Investment and Jobs Act (formerly known as the Bipartisan Infrastructure Law) and the Inflation Reduction Act, the U.S. government provided billions of dollars for deployment of CCUS projects.

Each of these programs underscores the importance of carbon capture and storage (CCS) as a critical solution to reducing carbon dioxide emissions from hard-to-abate industries such as cement, steel, oil and gas refineries, and power generation.

Section 45Q Tax Credit

The U.S. Federal government provides a significant tax credit for each metric ton (1,000kg) of CO2 that is captured and sequestered or utilized for another purpose. The table to the right shows the applicable tax credit rate for each scenario.

| Point Source | Direct Air Capture | |

| Sequestration | $85/ton | $180/ton |

| Utilization | $60/ton | $130/ton |

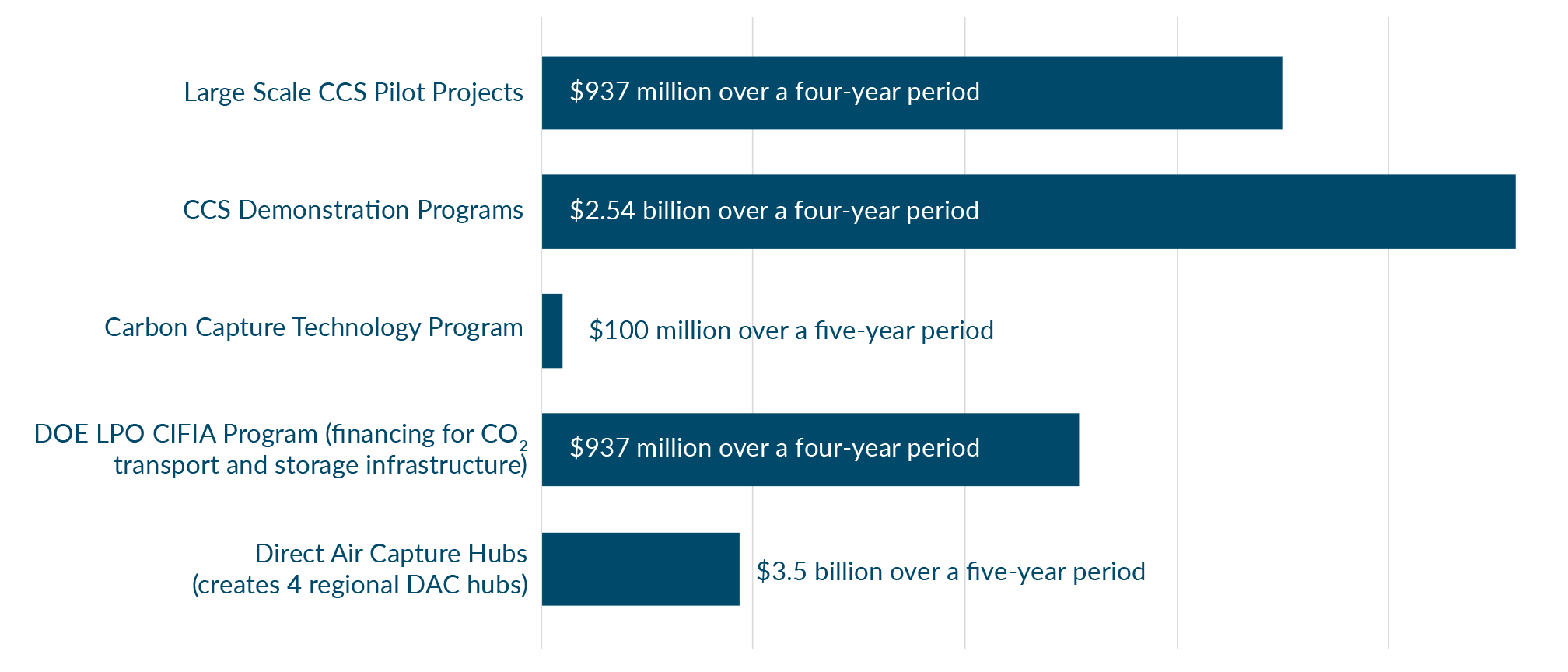

Infrastructure Investment and Jobs Act

The Infrastructure Investment and Jobs Act (IIJA) allocates over $62 billion for the U.S. Department of Energy (DOE), including historic investments in carbon management, both to mitigate and remove carbon dioxide emissions. As a part of the IIJA, DOE will deploy approximately $6.5 billion in new carbon management funding over five years, largely for direct air capture and carbon dioxide storage, as well as deploy an additional $11.5 billion of related DOE activities on carbon capture and storage (CCS) pilot projects and demonstrations.

Inflation Reduction Act

The Inflation Reduction Act (IRA) includes approximately $369 billion in incentives for clean energy and climate-related spending, including funding to encourage carbon capture, utilization, and storage (CCUS) projects. The IRA provides important updates to the 45Q tax credit to substantially increase the amount and availability of tax credits for CCUS by raising the credit amounts for facilities that capture carbon for geological storage or enhanced oil recovery (EOR). This allows smaller facilities to claim credits and permits direct payments. These provisions have the potential to significantly impact near- and long-term emissions reduction efforts.